Important Update for Medicare-eligible TRS-Care plan participants without Medicare Part B

If you’re a TRS-Care participant, when you turn 65 or become eligible for Medicare, you can enroll in TRS-Care Medicare Advantage and TRS-Care Medicare Rx. if you retire at age 65 or later, you can also enroll in these plans.

Your TRS-Care Medicare Advantage plan are different from what you may find on the private market. As a retired Texas public school employee, you’re entitled to comprehensive benefits at competitive prices.

To spot communications from TRS, look for TRS-Care Medicare Advantage and TRS-Care Medicare Advantage Rx logos on materials you get in the mail.

Visit our Medicare Comparison Checklist for considerations when evaluating health plans and key questions to think about when you sign up for Medicare.

Current TRS-Care Standard participants transitioning to TRS-Care Medicare Advantage: If you’re currently in TRS-Care Standard and enroll timely in Medicare this year, you won’t pay a deductible through Dec. 31 — if TRS has your Medicare Part A and/or Part B information before the first day of your birth month. Make sure to start your Medicare enrollment process 90 days before your 65th birthday — or if you’re over 65, start 90 days before your planned retirement date. And if you can get it for free, you must enroll in Medicare Part A. Your deductible resets each Jan. 1.

If you’re the retiree and you turn 65 before your covered spouse, you’ll enroll in TRS-Care Medicare Advantage and your spouse will stay on TRS-Care Standard. See page 4 of the TRS-Care Plan Highlights for TRS-Care Medicare Advantage premiums.

Yes. Participants with Medicare also pay a premium for Medicare Part B directly to Medicare. TRS doesn’t pay this premium on your behalf or deduct it from your TRS retirement annuity. Medicare deducts your Part B premium from your monthly federal benefit. You must buy and continue enrollment in Medicare Part B to be eligible for TRS-Care Medicare Advantage. Failure to buy and maintain Medicare Part B will result in total loss of TRS-Care. The cost of your Medicare premium depends on your income. If you have questions about how much you’ll pay for Medicare benefits, call Social Security at 1-800-772-1213. TTY users can call 1-800-325-0778.

No. You don’t have to pay another premium for prescription drug coverage. Your TRS-Care Medicare Advantage or TRS-Care Standard premium includes pharmacy coverage.

Yes. TRS-Care Medicare Advantage combines your Medicare coverage with enhanced TRS-Care coverage. When you see your doctor, you present only your TRS-Care Medicare Advantage UCard. Keep your Medicare ID card in a safe place.

Video: Compare with Ease

Watch our TRS-Care Medicare Advantage vs. Other Market Plans video to learn key differences between our plan and other options.

What is Medicare?

Medicare is the federal health insurance program that most Americans pay for through their FICA taxes. It’s for people aged 65 and older or disabled people under age 65. Medicare has four parts:

Medicare Part A covers hospitalization (e.g., inpatient visits).

Cost and Premium

Part A is free for most people. However, some TRS participants aren’t eligible for premium-free.

Part A. If you can’t get it for free, TRS doesn’t require you to sign up for it.

Medicare Part B covers medical services like your doctor’s office visits.

- Everyone pays a premium for Part B, and the amount depends on your annual income.

- You pay your Medicare premium directly to Medicare through your Social Security check, with quarterly or monthly payments.

- This is separate from the TRS-Care premium that TRS deducts from your monthly TRS annuity payments.

All TRS-Care participants who are eligible for Medicare must and maintain Part B to keep TRS-Care coverage. Without Part B, you will lose all TRS-Care medical and prescription drug coverage for yourself and any enrolled dependents.

Medicare Part C is a Medicare Advantage plan, such as TRS-Care Medicare Advantage. It bundles your Medicare coverage with your TRS-Care coverage.

- See the TRS-Care Plan Highlights for monthly premiums for you and your family. You pay this premium out of your monthly TRS annuity check. If the premium is greater than your annuity, TRS will bill you directly.

Medicare Part D is a prescription drug plan, such as TRS-Care Medicare Rx.

- Your TRS-Care premium covers this plan, so you won’t pay extra for it unless you exceed Medicare's income guidelines.

How do I enroll in Medicare?

How you enroll in Medicare depends on if you get Social Security benefits. Click the links below to learn how to sign up in each scenario.

How you enroll in Medicare depends on if you get Social Security benefits. Follow the links to learn how to sign up in each scenario.

Not getting Social Security benefits?

If you don’t currently get Social Security benefits, you need to do one of the following to enroll in Medicare:

Visit ssa.gov to apply online.

Call SSA toll-free at 1-800-772-1213

from 7 a.m – 7 p.m.,

Monday – Friday. TTY: 1-800-325-0778.

Visit your local Social Security office. ( call to make an appointment first. )

If you currently get Social Security benefits, SSA will automatically enroll you in Medicare on the first day of your 65th birthday month; or if your birthday falls on the first, the first of the previous month.

SSA will deduct the Medicare premium from your Social Security check.

When do I enroll in Medicare and TRS-Care?

Your enrollment period for TRS-Care depends on your Medicare status. Click the links below to learn how to sign up in each scenario:

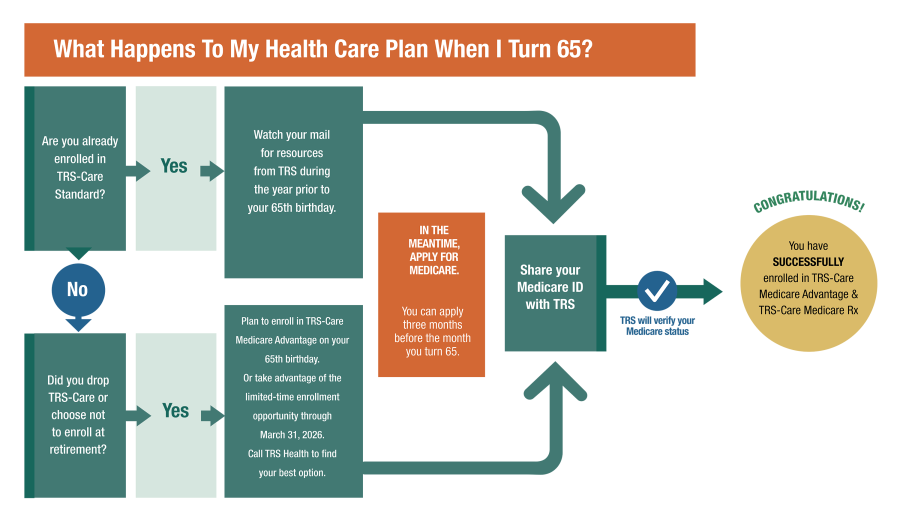

If you’re already enrolled in TRS-Care Standard, TRS Will send you information about TRS-Care Medicare Advantage plans one year before you turn 65.

64th Birthday Medicare Reminder

During your 64th birthday month, you’ll get a postcard from TRS to start familiarizing yourself with TRS-Care Medicare Advantage.

Start planning for Medicare & TRS-Care today

About nine months before your 65th birthday, TRS will send you more information to help plan for your Medicare enrollment. During this time, we encourage you to sign up for a TRS-Care Medicare Advantage & You webinar for an overview of your TRS-Care Medicare Advantage enrollment, eligibility, and medical and prescription drug benefits.

Explore TRS-Care Medicare Advantage plan benefits

Six months before your 65th birthday, TRS will send you details about your TRS-Care Medicare Advantage benefits.

TRS-Care Medicare Advantage Enrollment Packet

About three months before your 65th birthday, TRS will send you an enrollment application to fill out if you want to add dependents. This packet will also have then TRS-Care Plan Highlights, TRS-Care Medicare Advantage Enrollment Guide and TRS-Care Medicare Rx Summary of Benefits.

UnitedHealthcare Plan Guide

Three months before your 65th birthday, UnitedHealthcare will also send you a copy of their TRS-Care Medicare Advantage Plan Guide. This has important information related to the plan along with the extra value-added services available to you.

Read through these plan materials to learn more about the TRS-Care Medicare Advantage plan.

Three months before your 65th birthday, you should sign up for Medicare and prepare to enroll in TRS-Care Medicare Advantage. Once you sign up for Medicare, share your Medicare Beneficiary Identifier (MBI) with TRS so you can get timely coverage through TRS-Care when you turn 65.

Share your MBI by calling TRS Health at 1-888-237-6762 or filling out the form UnitedHealthcare sent you, and sending it back to TRS.

Starting Jan, 1, 2021, United Healthcare insures TRS-Care Medicare Advantage..

If you're retiring and about to be eligible for Medicare or you're already eligible, TRS will send you an enrollment packet that includes the TRS-Care Guide for Medicare-Eligible Participants and a TRS-Care application.

TRS will send you a TRS-Care application when we get and process your TRS retirement application and determine you're eligible for TRS-Care.

If you want to enroll in TRS-Care, you should complete the TRS -Care application and return it to TRS.

During this "Initial Enrollment period," you can also add your eligible dependents to your TRS-Care coverage. TRS will enroll them in the appropriate plan based on their Medicare status (for example, if your spouse isn't yet eligible for Medicare, TRS will Enroll them the TRS-Care Standard for people under age 65.

If you're applying for disability retirement, TRS will send you a TRS-Care enrollment packet when the TRS Medical Board approves your disability retirement.

If you choose not to enroll in TRS-Care during your Initial Enrollment period, you do not need to take any action.

If you never enrolled in TRS-Care but were eligible for the program when you retired, or if you previously dropped TRS-Care, you can enroll yourself and your eligible dependents at age 65.

We'll send you a postcard about four months before your 65th birthday inviting you to contact us for an enrollment packet.

As a TRS-Care retiree, you can also add eligible dependents to your TRS-Care coverage when you reach age 65. This enrollment opportunity is not available to dependent spouses or children when they turn 65.

What should I do after I enroll in Medicare?

Additional Resources

TRS-Care Medicare Advantage & You Quarterly Webinars

TRS hosts a quarterly webinar called "TRS-Care Medicare & You" for participants who will soon be eligible for Medicare! This webinar will help you understand the enrollment process and how TRS-Care Medicare provides the care you can count on for this next stage of your life.